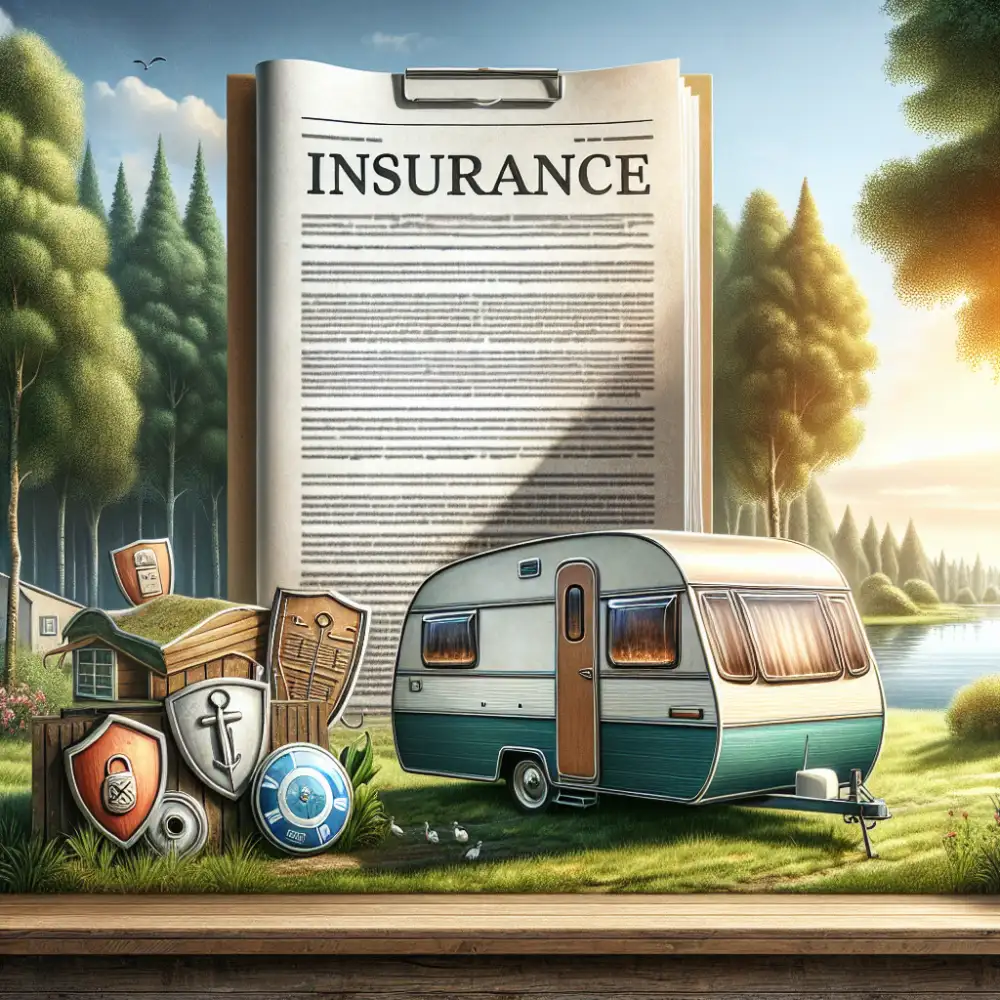

Finance: Secure Your Home on Wheels: The Ultimate Guide to Caravan Insurance

Caravan insurance cost

Caravan insurance costs vary depending on several factors, including the caravan's value, age, and type, as well as your location and usage. Generally, you can expect to pay anywhere from a few hundred to over a thousand pounds per year for comprehensive cover. Factors that can increase your premium include storing your caravan in a high-risk area, having a poor claims history, or opting for a higher level of coverage. Conversely, you may be able to lower your costs by installing security features, joining a caravanning club, or choosing a higher excess. It's always recommended to compare quotes from multiple insurers to find the best coverage at the most competitive price.

Payment options

We offer a variety of secure payment options to make your shopping experience as convenient as possible. We accept all major credit cards, including Visa, Mastercard, American Express, and Discover. You can also pay with PayPal, Apple Pay, or Google Pay. If you prefer to pay later, we offer financing options through Klarna and Affirm. Our website uses the latest encryption technology to protect your personal and financial information. You can shop with confidence knowing that your payments are safe and secure.

Potential discounts

Potential discounts can make a product more attractive to buyers. These can include sales, coupons, and promotional offers. Sales are often time-limited events where products are offered at reduced prices. Coupons, on the other hand, provide a specific discount on a particular item or order total. Promotional offers can vary widely, ranging from free shipping to buy-one-get-one deals. By taking advantage of these discounts, consumers can save money on their purchases. However, it's important to be mindful of marketing tactics and ensure that discounts genuinely represent savings and not just encourage unnecessary spending.

| Feature | Provider A | Provider B |

|---|---|---|

| Basic Coverage | Fire, Theft, Storm Damage | Fire, Theft |

| Accidental Damage | Optional | Not Covered |

| Contents Coverage | Up to £5,000 | Up to £2,000 |

| European Cover | Available | Not Available |

Making a claim

If you've experienced a loss covered by your insurance policy, it's time to file a claim. Start by gathering all relevant documentation, such as your policy number, incident reports, and any supporting evidence like photos or videos. Contact your insurance company to initiate the claim process, providing them with the necessary information. Your insurer will guide you on the specific procedures and required forms. A claims adjuster will be assigned to your case to assess the damage and investigate the circumstances of the loss. Stay in contact with your adjuster and promptly provide any requested information to ensure a smooth claims process.

Excess and deductibles

Excess and deductibles are common features of insurance policies that can significantly impact the cost of coverage and what you pay out of pocket in the event of a claim. An excess, also known as a deductible, is the amount you agree to pay towards a claim before your insurance coverage kicks in. It's typically a fixed amount, such as $500 or $1,000, but it can also be a percentage of the insured value. A higher excess generally means lower premiums, while a lower excess often results in higher premiums. On the other hand, a deductible is the specific amount you must pay out of pocket for covered medical expenses before your insurance plan starts covering the costs. Understanding the difference between excess and deductibles and how they work is crucial for choosing the right insurance policy and managing your finances effectively.

Agreed value vs market value

When insuring your car, understanding the difference between agreed value and market value is crucial. Market value refers to the amount your car is currently worth in the marketplace, considering factors like depreciation and current car values. This value can fluctuate based on various market conditions. On the other hand, agreed value is a predetermined amount that you and your insurer agree upon when you purchase the policy. This value represents the car's worth regardless of market fluctuations, providing you with a guaranteed payout in case of a total loss.

Finance for insurance premiums

Financing insurance premiums can be done in several ways. The most common is simply paying the premium upfront, either annually or in installments. However, other options might be available depending on the insurer and policy type. Some insurers offer premium financing, where they loan you the money to pay the premium, and you repay the loan with interest. This can be helpful if you don't have the cash flow to pay the entire premium at once. Another option is to use a credit card that offers rewards or points for insurance payments. This can help you offset the cost of the premium. Finally, some employers offer payroll deduction for insurance premiums, which can make budgeting easier.

Impact of claims on premiums

The number of claims you make directly impacts your insurance premiums. It's simple - the more claims you make, the higher your premiums are likely to be. Why? Because insurance companies see policyholders with a history of claims as riskier to insure. Each claim filed raises your risk profile in their eyes, leading to potential premium increases upon renewal or even policy non-renewal. This applies to various insurance types, including auto, home, and health insurance. However, the extent of the impact varies depending on factors like the severity of the claim, your insurer's policies, and your location.

Published: 18. 06. 2024

Category: Food