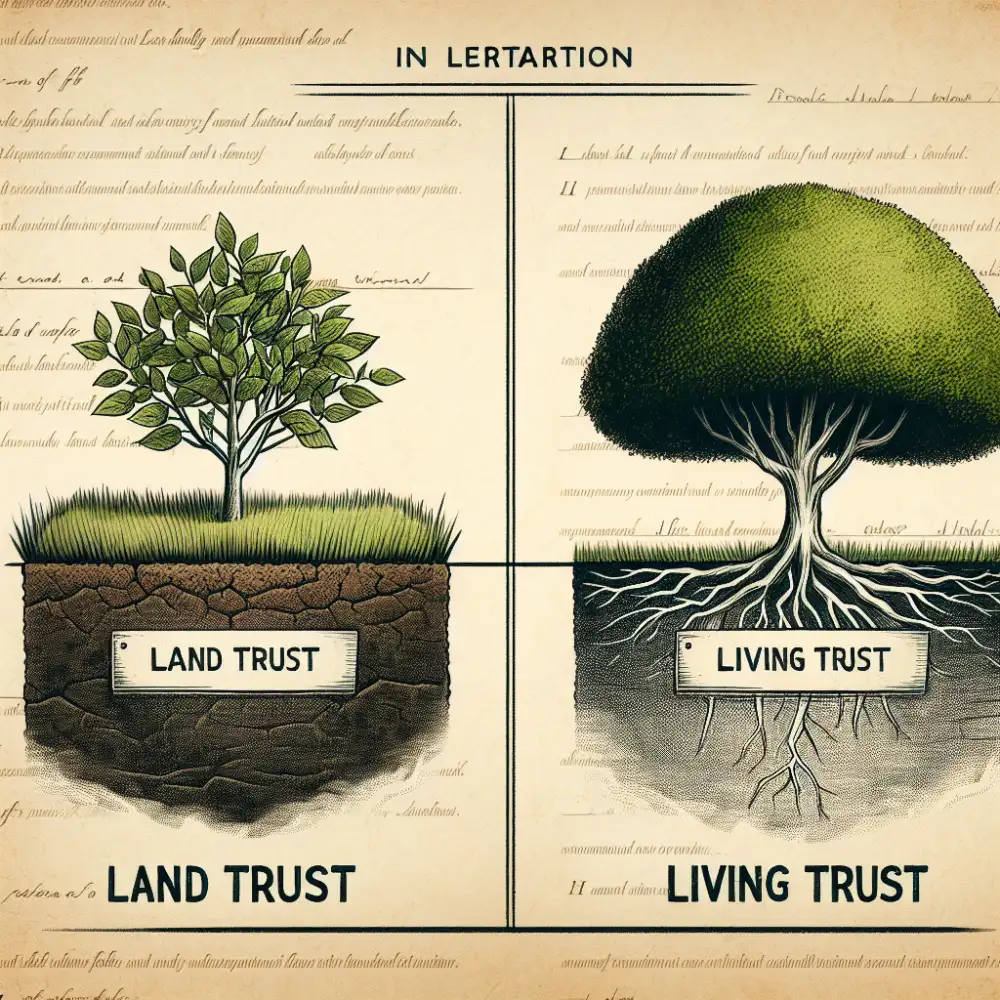

Land Trust vs. Living Trust: Which One Protects Your Assets Best?

Asset Protection

Asset protection involves safeguarding your possessions, including your home, car, investments, and savings, from potential creditors and lawsuits. It's about creating a strategic plan to shield your hard-earned assets. This often involves utilizing legal tools and strategies, such as trusts, limited liability companies (LLCs), and strategic insurance coverage. These methods can make it more difficult for creditors to seize your assets in the event of a lawsuit or financial hardship. Asset protection is a proactive approach to safeguarding your financial future and ensuring that your wealth is preserved for you and your loved ones. It's essential to consult with an experienced attorney to determine the most effective asset protection strategies for your specific circumstances.

| Feature | Land Trust | Living Trust |

|---|---|---|

| Primary Purpose | Hold real estate for conservation or privacy purposes | Manage assets for beneficiaries during life and after death |

| Type of Assets Held | Real estate only | Real estate, personal property, financial instruments |

| Privacy | High, ownership is not public record | May offer some privacy depending on state laws |

| Probate Avoidance | Yes, for the real estate held in the trust | Yes, for all assets held in the trust |

| Cost to Establish | Varies by state and complexity, generally moderate | Varies by state and complexity, generally lower than land trusts |

Tax Implications

It's important to remember that tax laws can be complex and vary depending on individual circumstances. It's always best to consult with a qualified tax professional for personalized advice. They can help you understand the specific tax implications related to your situation, ensuring you meet all legal requirements and optimize your tax outcomes. Remember, staying informed and seeking professional guidance can save you from potential headaches and unexpected tax liabilities in the long run.

Costs and Fees

It’s important to factor in any potential costs and fees before making a financial decision. These can vary depending on the specific product or service. Common costs include account maintenance fees, transaction fees, and interest charges. Fees might be a flat rate or a percentage of the transaction. Some institutions offer fee waivers or discounts under certain conditions. Always review the terms and conditions or a fee schedule to understand the potential costs involved. Consider comparing costs from different providers to ensure you’re getting a competitive rate. Remember, even small fees can add up over time, impacting your overall returns.

Control and Ownership

Control and ownership are distinct but interconnected concepts. Control refers to the ability to exert influence over an entity's strategic direction and decision-making processes. Ownership, on the other hand, pertains to the legal possession and rights associated with an asset, which can be tangible or intangible. While ownership often confers control, this is not always the case. For instance, a shareholder with a minority stake in a company may have limited control over its operations. Conversely, contractual agreements or regulatory frameworks can grant control rights to entities without ownership. The interplay between control and ownership has significant implications for corporate governance, competition law, and economic policy. Understanding the nuances of these concepts is crucial for investors, policymakers, and businesses alike.

Privacy Considerations

When using large language models, especially those trained on massive datasets of text and code, it is crucial to be mindful of privacy. These models can inadvertently memorize and potentially expose sensitive information contained within their training data. This information could include personal names, addresses, phone numbers, or other private details that were present in the dataset.

While efforts are made to scrub and anonymize training data, it is impossible to guarantee complete removal of all sensitive information. Additionally, these models can sometimes be manipulated to generate outputs that reveal private information, even if not explicitly prompted to do so. Therefore, it is essential to avoid inputting any sensitive information into these models and to treat their outputs with caution, especially when dealing with personally identifiable information or other confidential data.

Published: 10. 06. 2024

Category: finance